More About Clark Wealth Partners

Wiki Article

3 Easy Facts About Clark Wealth Partners Described

Table of ContentsThe Basic Principles Of Clark Wealth Partners The Basic Principles Of Clark Wealth Partners The 3-Minute Rule for Clark Wealth Partners4 Easy Facts About Clark Wealth Partners DescribedLittle Known Questions About Clark Wealth Partners.The 2-Minute Rule for Clark Wealth PartnersThe smart Trick of Clark Wealth Partners That Nobody is DiscussingTop Guidelines Of Clark Wealth Partners

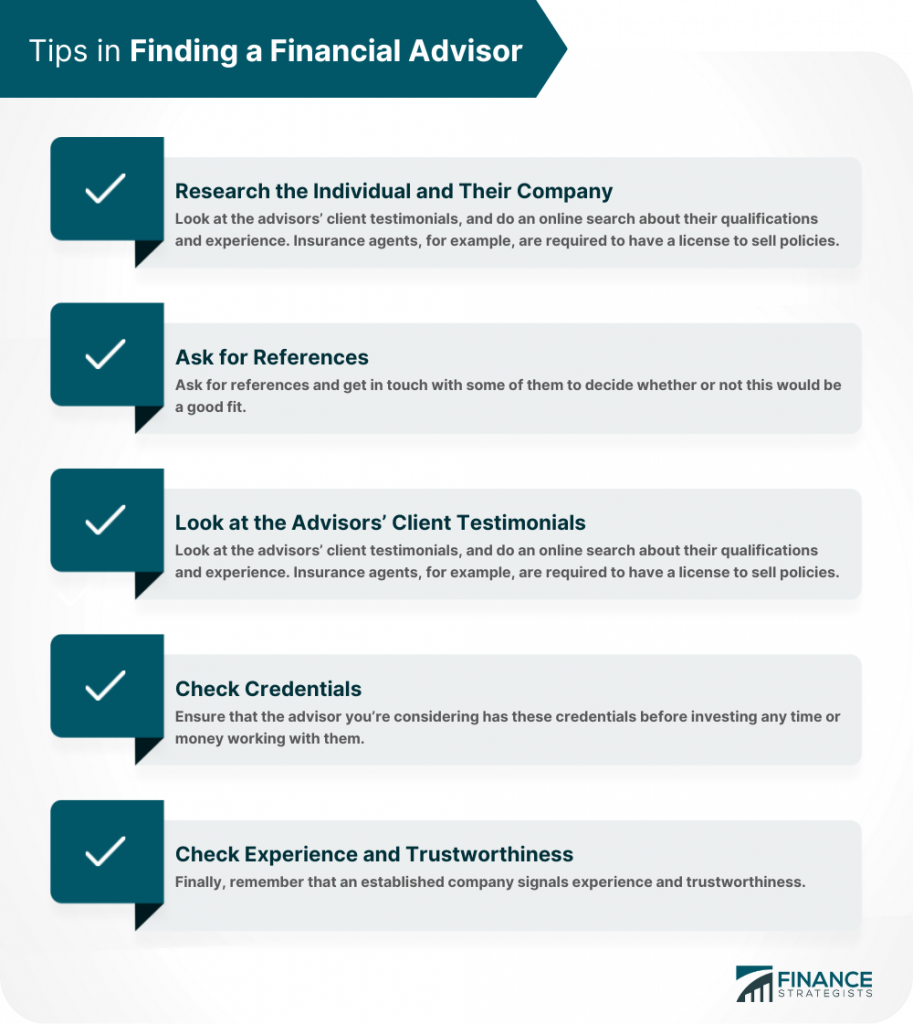

Common factors to consider a monetary advisor are: If your economic circumstance has ended up being extra complex, or you do not have confidence in your money-managing abilities. Saving or navigating significant life events like marriage, divorce, children, inheritance, or task change that might considerably impact your financial scenario. Browsing the transition from saving for retired life to maintaining wide range throughout retirement and exactly how to create a strong retirement revenue strategy.New innovation has caused more extensive automated financial tools, like robo-advisors. It depends on you to check out and identify the ideal fit - https://www.reddit.com/user/clrkwlthprtnr/. Ultimately, a great financial consultant ought to be as conscious of your financial investments as they are with their own, avoiding extreme fees, saving cash on tax obligations, and being as transparent as possible regarding your gains and losses

Clark Wealth Partners Can Be Fun For Anyone

Gaining a commission on item recommendations doesn't always suggest your fee-based consultant works against your finest passions. They may be extra inclined to recommend products and solutions on which they earn a commission, which might or might not be in your best passion. A fiduciary is lawfully bound to place their client's rate of interests.They may comply with a loosely kept an eye on "suitability" standard if they're not registered fiduciaries. This common permits them to make recommendations for investments and services as long as they match their customer's goals, risk resistance, and economic scenario. This can translate to suggestions that will likewise make them money. On the other hand, fiduciary experts are legally obliged to act in their customer's benefit instead of their own.

Clark Wealth Partners - An Overview

ExperienceTessa reported on all points investing deep-diving into intricate economic topics, clarifying lesser-known financial investment avenues, and discovering means readers can work the system to their benefit. As a personal finance professional in her 20s, Tessa is acutely knowledgeable about the impacts time and uncertainty have on your financial investment decisions.

It was a targeted advertisement, and it functioned. Learn more Check out much less.

3 Simple Techniques For Clark Wealth Partners

There's no solitary path to becoming one, with some people beginning in banking or insurance, while others begin in audit. A four-year degree gives a solid foundation for occupations in financial investments, budgeting, and client solutions.

The Facts About Clark Wealth Partners Revealed

Common examples consist of the FINRA Collection 7 and Collection 65 exams for safety and securities, or a state-issued insurance certificate for marketing life or health insurance policy. While credentials might not be legitimately required for all preparing roles, employers and customers commonly view them as a standard of professionalism. We take a look at optional credentials in the following area.Many monetary organizers have 1-3 years of experience and experience with monetary items, conformity standards, and direct customer interaction. A strong educational background is essential, yet experience shows the ability to use concept in real-world setups. Some programs integrate both, permitting you to finish coursework while earning monitored hours with internships and practicums.

An Unbiased View of Clark Wealth Partners

Several get in the area after operating in financial, accounting, or insurance policy, and the shift calls for perseverance, networking, and usually innovative qualifications. Very early years can bring long hours, pressure to build a customer base, and the need to continuously show your experience. Still, the profession provides strong long-lasting potential. Financial planners take pleasure in the possibility to function closely with customers, overview essential life choices, and commonly attain adaptability in schedules or self-employment.

They spent much less time on the client-facing side of the market. Nearly all economic supervisors hold a bachelor's degree, and several have an MBA or similar graduate level.

Excitement About Clark Wealth Partners

Optional qualifications, such as the CFP, normally call for extra coursework and testing, which can prolong the timeline by a pair of years. According to the Bureau of Labor Statistics, individual economic experts make a median annual yearly salary of $102,140, with top earners earning over $239,000.In various other provinces, there are guidelines that require them to satisfy certain demands to make use of the monetary advisor or economic coordinator titles (financial company st louis). What establishes some economic experts besides others are education, training, experience and certifications. There are several designations for monetary consultants. For economic planners, there are 3 common classifications: Certified, Personal and Registered Financial Planner.

4 Simple Techniques For Clark Wealth Partners

Those on wage might have a reward to advertise the product or services their employers supply. Where to locate a monetary expert will depend on the kind of suggestions you require. These organizations have personnel who may aid you understand and get particular kinds of investments. Term down payments, ensured investment certifications (GICs) and common funds.Report this wiki page